Healthcare Choices in Retirement: Navigating Medicare Advantage vs. Original Medicare in Philadelphia

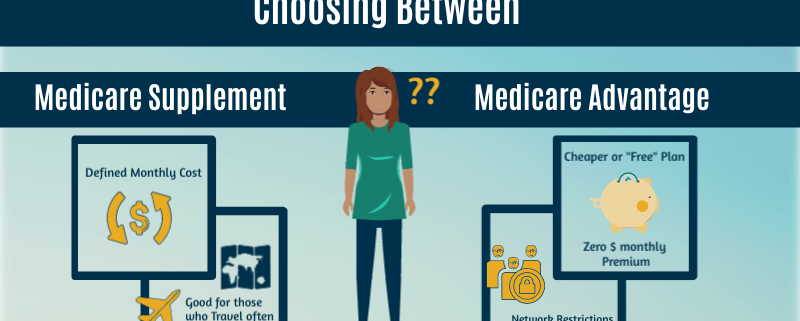

As you approach retirement age, understanding your healthcare options becomes paramount. In Philadelphia, seniors have access to both Medicare Advantage and Original Medicare plans. Navigating these options effectively requires a clear understanding of the differences, benefits, and considerations involved. Let’s explore the key aspects of Medicare Advantage vs. Original Medicare to help you make informed decisions about your healthcare coverage in retirement..